Airlie Small Companies Fund Investor Letter

Download Combined Letter & Factsheet (PDF)

Download Combined Letter & Factsheet (PDF)

For the June quarter, the Fund returned -1.61% compared to the Small Ordinaries Accumulation Index return of -4.46%, reflecting outperformance over the period of 2.85%.

The top three contributors to gross performance during the quarter were Gentrack (+1.5%), Joyce (+0.7%) and News Corp (+0.3%). The top three detractors from gross performance were Nick Scali (-0.6%), Tabcorp (-0.5%) and Smartpay (-0.5%).

There were some notable events during the quarter for our portfolio positions. Nick Scali announced its entry into the UK market with the acquisition of Fabb Furniture. While we are usually sceptical of overseas expansions, there are a few reasons why we are more optimistic on the prospects for Nick Scali, which we discuss below in our stock story.

Tabcorp announced the hiring of Gillon McLachlan to fill the company’s vacant CEO role, bringing to the organisation valuable commercial and media expertise. The New South Wales Government also announced the establishment of a formal process to review the wagering tax regime. While Tabcorp will have to compensate the Government for any change in the terms of the licence, we welcome further steps towards a level playing field with online bookmakers.

Premier Investments announced a potential merger of its Apparel Brands with separately listed Myer. This announcement comes after a strategic review by management aimed at creating value for shareholders. We view the proposed merger positively as it would serve the dual purpose of creating a stable home for the Apparel Brands business while also allowing for a separate listing of the higher-quality Peter Alexander and Smiggle brands. This announcement serves as yet another reminder of the importance of partnering with aligned management.

During the quarter, we materially upweighted our position in Smartpay, a provider of merchant services and payment terminals in Australia and New Zealand. We have held a small position in Smartpay in the Fund for more than a year. Our decision to upweight the position comes after the release of the company’s FY24 result, which outlined their impending model transition in the New Zealand market. Our analysis indicates this change in model will unlock material hidden value in the company’s New Zealand terminal base, which we believe is not currently reflected in the share price.

2024 Year InReview

Below we provide a review of our FY24 performance.

The Fund had a strong FY24, returning 23.96% compared to the Small Ordinaries Accumulation Index return of 9.34%, reflecting outperformance over the period of 14.62%.

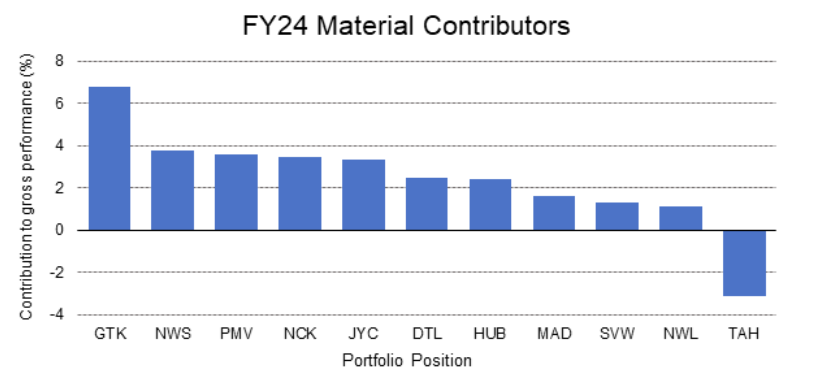

The chart below provides the material contributors (>1%) to gross performance for the Fund in FY24.

As can be seen in the chart, performance has pleasingly come from a number of ‘winners’ during the year, offset by only one material detractor.

There were a few noteworthy contributors worth individual mention. Gentrack was the Fund’s strongest performer over the year, contributing +6.8% to gross Fund performance. For those new to the story, Gentrack provides customer billing software to the utility sector and customer management software to the airport sector. We like businesses that sell this type of ‘mission-critical’ enterprise software as typically the customer churn is very low due to how costly and disruptive it can be to switch providers. That low customer churn creates resilient, annuity-style revenues. Prior to our purchase, Gentrack had endured a tough few years navigating some customer closures related to regulatory issues in the UK that resulted in materially reduced profit margins. We viewed these issues as mostly temporary and added to our position on signs of improving revenue growth and a recovery in margins. While the stock has had a great run, Gentrack has a long runway for growth as utilities continue to upgrade their systems to meet the demands of the energy transition and profit margins return towards historical levels.

News Corp has been another strong performer for the Fund, contributing +3.8% to gross Fund performance. Our thesis here centred around the Dow Jones segment, which has vastly improved in quality over the past decade, transitioning from an advertising to a subscription-led model, which we believed the market had underappreciated. This thesis has largely played out, with Dow Jones posting some stellar results in recent periods. We wrote a more in-depth analysis of News Corp in our September Fund Update, which can be found on the Airlie website.

The Fund’s retail positions have also been strong performers, collectively contributing +10.6% to gross performance in FY24. The largest contributors here were Premier Investments, Nick Scali and Joyce Corporation. Retail has been an interesting sector during the past year – who would have predicted that many retailers would still be making close to record profits and margins after such a rapid rise in interest rates and further cost of living pressures? That resilience has certainly exceeded our expectations, and we think there’s an important lesson there in the fallibility of making macroeconomic predictions. While we’ve held large retail positions in the Fund since inception, our theses for these stocks were never predicated on any special insight into the macro, but rather individual analysis of the companies which highlighted resilient business models, stellar management and fortress balance sheets. We believed these qualities would allow them not only to weather a severe downturn in consumer spending but emerge out the other side in a stronger competitive position.

On the other side of the ledger, Tabcorp was the Fund’s weakest performer during the year, contributing -3.1% to Fund performance. While operationally the company has achieved some milestones in terms of levelling the playing field with online bookmakers, the stock has struggled against the backdrop of a soft wagering market. We had probably underestimated how much the business was overearning due to covid, which has dampened our expectations for future returns. Nevertheless, we view the recent hiring of Gillon McLachlan as CEO and the NSW Government’s decision to formally review the wagering tax regime as clear positives, and we believe the stock remains cheap here, trading on around 10x our estimate of free cash flow. For this reason, we remain patient holders. For a more in-depth discussion on Tabcorp, see our December Fund Update, which can be found on the Airlie website.

Looking ahead, we remain very excited about the Fund’s future prospects. The small cap market offers the chance to invest in the leading companies of tomorrow with decades of growth ahead of them. There are over 700 securities within our investment universe from which we selectively construct a concentrated portfolio of high-grade opportunities. As a team, Airlie have been successfully investing in small companies for several years now and we have a robust process of identifying these opportunities. We believe the Fund remains well positioned to continue this into the future.

Will Granger, Portfolio Manager

Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management (‘Airlie’). This material is issued by Airlie and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any fund, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Further information regarding any benchmark referred to herein can be found at www.airliefundsmanagement.com.au/benchmark-information/. Any third-party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third-party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie.