BlueScope (ASX: BSL) is a recent addition to the Airlie Australian Share Fund.

We are hardly the first fund manager to declare BlueScope cheap. The company trades on a P/E of less than 10x despite owning one of Australia's highest-quality building material products (COLORBOND). CSR is leaving the boards at 20x FY25 P/E and Boral off to Seven Group at ~24x FY25 P/E. BlueScope's North Star Electric Arc Furnace (EAF) is arguably the best steelmaking asset in North America, yet US steelmakers Nucor, Steel Dynamics and US Steel all trade on P/E ~20% higher than BlueScope. While steelmaking is both deeply cyclical and highly capital intensive, BlueScope management continue to demonstrate an excellent approach to capital allocation that mitigates the existential downside risks associated with these sorts of businesses. More importantly, the company is in the process of executing several attractive organic growth projects that will lift through-the-cycle cash flow and drive greater capital returns to shareholders over the medium term.

"For deeply cyclical businesses like steelmakers, balance sheet strength is particularly necessary to manage

through periods of end market weakness."

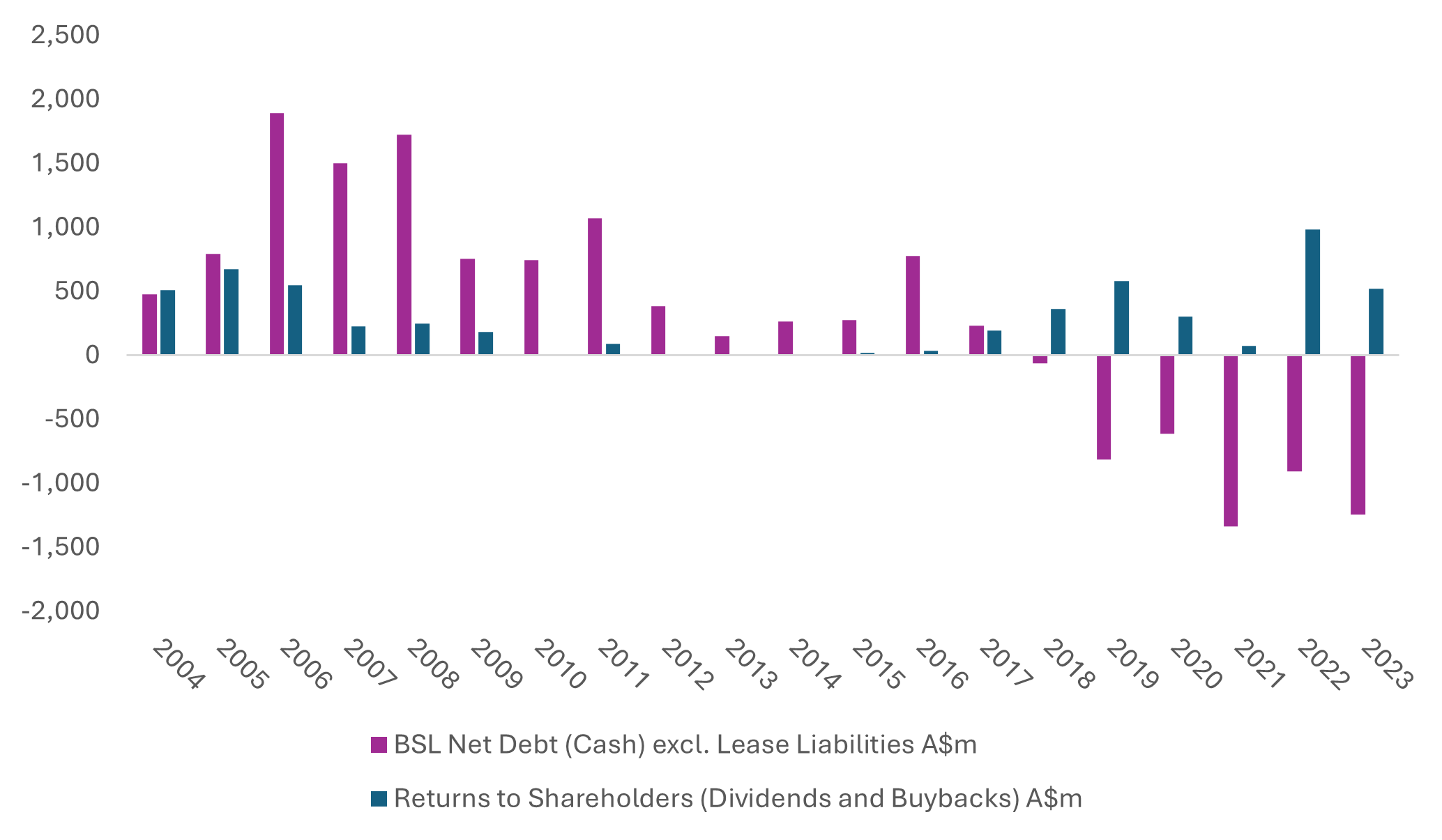

BlueScope is a diversified steelmaker and steel building products manufacturer with operations across Australia, New Zealand, North America and Asia. At Airlie we always start with an assessment of the strength of a company's balance sheet in our investment process, as we believe many fail to value the optionality a strong balance sheet provides in terms of capital management and downside protection and, conversely, the dilutive power of a poor balance sheet. For deeply cyclical businesses like steelmakers, balance sheet strength is particularly necessary to manage through periods of end market weakness. In BlueScope's case, the balance sheet is in rude health. The company is $1.1b net cash (excluding lease liabilities) and has a portfolio of surplus land in Australia potentially worth ~$500m. This means at the current share price BlueScope has almost 20% of its market cap in cash and surplus land. We would also argue that there are businesses within BlueScope that, despite generating a decent ROIC, could be considered non-core, such as the southeast Asian and Indian JVs, as well as BlueScope China, which combined have a book value of ~$1b.

Figure 1: BlueScope surplus land portfolio

Substantial Portfolio of Land

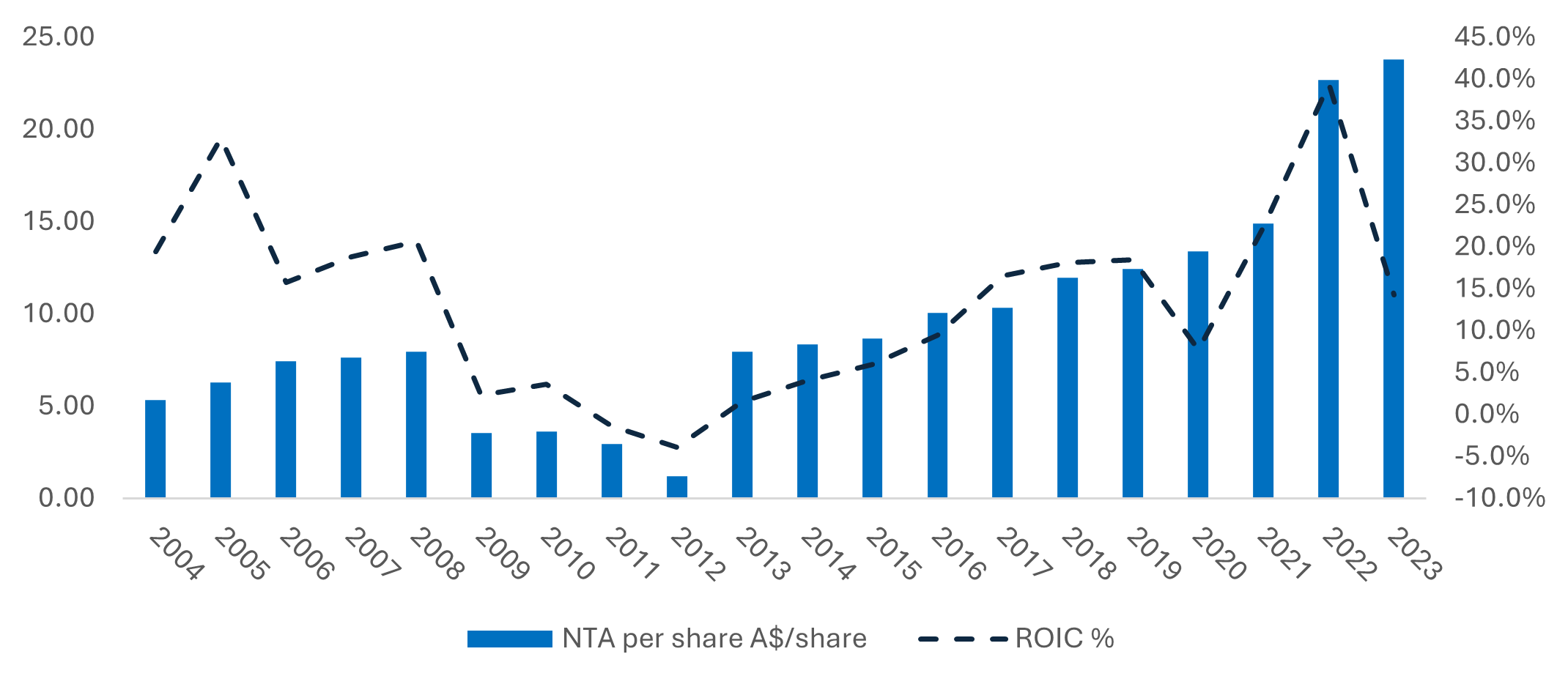

From a business quality perspective, we look at return on invested capital to guide us as to the quality of a company. With this in mind, the past decade has been hugely productive for BlueScope. In Australia, there has been a structural improvement in returns as a function of the restructure of the Port Kembla steelworks and the continued penetration of the company's high-margin steel building products through the residential housing market.

Figure 2: BlueScope's Australian business EBITDA per tonne versus the East Asian steel spread

Asian steel spread1 & ASP EBITDA per tonne ($A/t)

Source: BlueScope 1H24 Financial Presentation

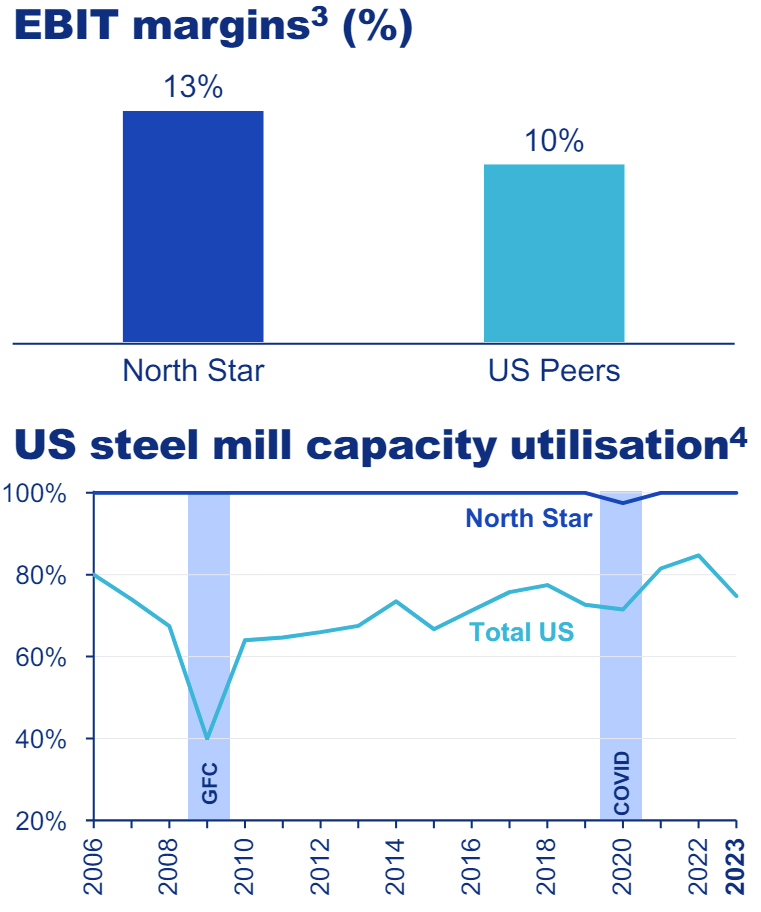

Figure 3: North Star FY23 EBIT margin and historical utilisation

Source: BlueScope FY23 Financial Presentation

In North America, industry returns have improved as steelmaking capacity has been consolidated and protected, which should support stronger steel spreads and ultimately higher earnings from BlueScope's North Star EAF into the medium-term. North Star's market position over the past two decades as a top quartile asset from a cost and utilisation perspective gives us confidence that through-the-cycle returns will be strong. For context, BlueScope increased ownership of North Star from 50% to 100% in 2015 for US$720m. Since then North Star has generated ~US$3.5b in EBIT at an average ROIC >20%.

The net of these tailwinds has been a significant improvement in return on capital, cash generation and balance sheet strength over the past decade, as well as outstanding returns for shareholders. From 2017 to 2023, BlueScope bought back almost 20% of its shares on issue at an average price of $15.50 per share.

Figure 4: BSL Return on capital invested

BlueScope – NTA per share and ROIC

Source: BlueScope, Airlie Funds Management

Figure 5: BSL Net debt (cash) and returns to shareholders

BlueScope – Net Debt (Cash) and Shareholder Returns

Source: BlueScope, Airlie Funds Management

Despite the considerable cash returned to shareholders via dividends and buybacks (~$2.5b over the past five years, not including the current buyback program), what makes us positive on BlueScope at Airlie are the attractive organic growth opportunities to deploy cash in the future.

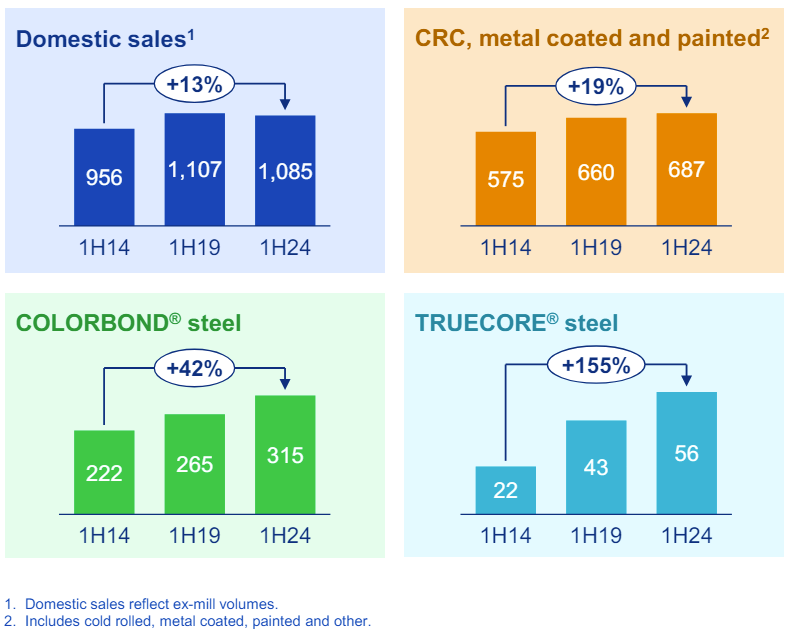

The strategic ethos of BlueScope from an operational perspective is to run the cyclical upstream parts of their business (i.e. the steelmaking assets) at the lowest cost possible and invest in downstream businesses that are higher margin and reduce the cyclicality of the overall group – think value-added steel and steel building products. In Australia, BlueScope continues to mitigate the cyclicality of the Port Kembla steelworks by growing the penetration of high-value products like COLORBOND roofing and, to a lesser extent, TRUECORE steel frames. COLORBOND has an estimated 60-70% share of new single-family rooves nationally. BlueScope is investing $1.15b to extend the life of the Port Kembla steelworks and $415m to increase downstream coating capacity. The Port Kembla investment protects the margins of the integrated business for the next two decades, while the coating investment unlocks more capacity for COLORBOND and TRUECORE volume, which lift the average revenue and earnings per tonne of steel produced.

Figure 6: BlueScope Australia despatch volumes by category and product

Dispatch volumes by category / product (Kt)

Source: BlueScope 1H24 Financial Presentation

In North America, BlueScope has recently completed an expansion of North Star from 2,150ktpa of flat steel production to 3,000ktpa for US$750m. BlueScope will undertake an additional debottlenecking program that would increase production capacity from 3,000ktpa to 3,500ktpa for ~US$150m. If we consider this reinvestment as a single $900m project, on our mid-cycle steel spread assumptions it will generate a return of close to 20%, a function of North Star's position on the cost curve.

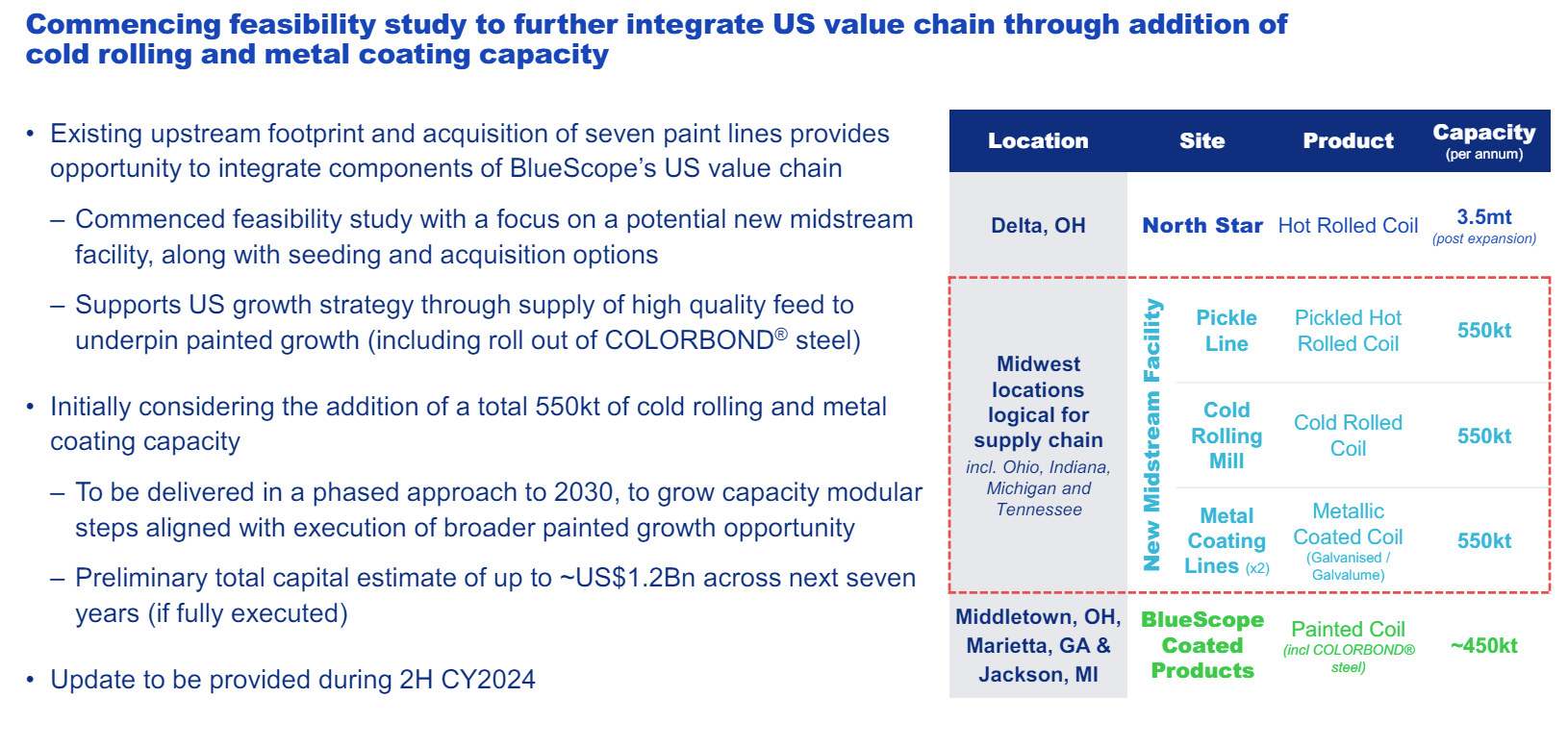

BlueScope has also identified an opportunity to vertically integrate its US operations and grow volumes in industrial (and eventually residential) steel roofing, leveraging the company's existing capability in Australia (COLORBOND). BlueScope have spent US$500m acquiring downstream metal painting assets and are evaluating a potential US$1.2b investment in metal coating capacity that would create a vertically integrated steel building products business. While this is more of a medium-term opportunity, we believe a ROIC of 15% (or an incremental US$250m of EBIT) is achievable for BlueScope on this combined investment over time. This return is available through vertical integration both upstream and downstream, and effectively being able to buy coated steel at variable cost rather than at margin. The demand here is buoyed by US policy subsidising investment in infrastructure, critical supply chains and reshoring activities. This investment would be staged sensibly within the confines of the company's cash flow generation.

Figure 7: Potential North America mid-stream investment

Advancing our US value chain integration

Source: BlueScope 1H24 Financial Presentation

The point here is that BlueScope has no shortage of quality investment opportunities that will drive through-the-cycle earnings growth, reduce overall earnings volatility and grow the intrinsic value of the business over time.

A large part of BlueScope's success over the past decade has been excellent decision-making and capital allocation by the management team and board. Current CEO Mark Vassella has been with BlueScope since 2007 and CEO since 2018. Mark ran BlueScope Australia and New Zealand from 2011-2017 and was instrumental in the restructuring of Port Kembla, which has structurally improved the returns in Australia. CFO David Fallu recently joined from CSR where he was CFO for six years. During his tenure at CSR he created significant value developing the company's strategy for its surplus property holdings, evident in Saint-Gobain's takeover at $9/share. At a divisional level, Tania Archibald (Chief Executive Australian Steel Products) and Kristie Keast (Chief Executive North America) each have over 20 years’ tenure at BlueScope across various divisions. BlueScope's near-death experience through the first half of the 2010s is still front of mind for management, and ultimately drives the focus on low cost of production and a healthy balance sheet. For BlueScope, organic investment must compete from a returns perspective with buying back stock, which is a significant hurdle given the company's current multiple.

The final part of our investment process at Airlie is valuation. We look at valuation last given in isolation, the multiple of earnings at which a company trades is pretty meaningless. It's only once a company's financial strength, business quality, earnings outlook and management team have been analysed that a valuation has context.

Trading multiples

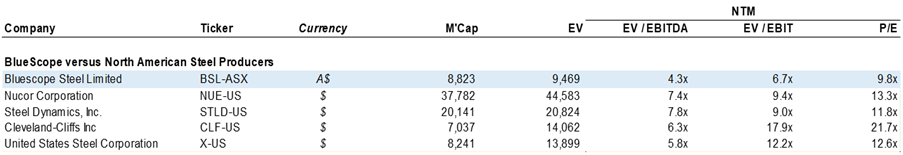

It’s often a useful exercise to benchmark a company's returns and multiples to those of the average business in the market. The average ASX 200 Industrial business trades on a forward P/E of ~19x and generates a pre-tax ROIC of ~13%. BlueScope trades on a forward P/E of ~10x and on our numbers generates a through-the-cycle ROIC of ~15%. At a high level, BlueScope looks cheap relative to the market. North American steelmakers Nucor, Steel Dynamics, US Steel and Cleveland Cliffs are imperfect but useful comps for BlueScope in that they are all vertically integrated (to some extent) North American steel businesses, which is where BlueScope has generated most of its earnings over the past five years. As you can see via the table below, BlueScope trades at a meaningful discount to the basket despite similar end-market exposure and a best-in-class steelmaking asset.

Table 1: BlueScope and North American peers

Source: FactSet, Airlie Funds Management

Sum of the parts

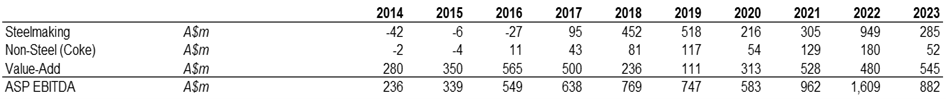

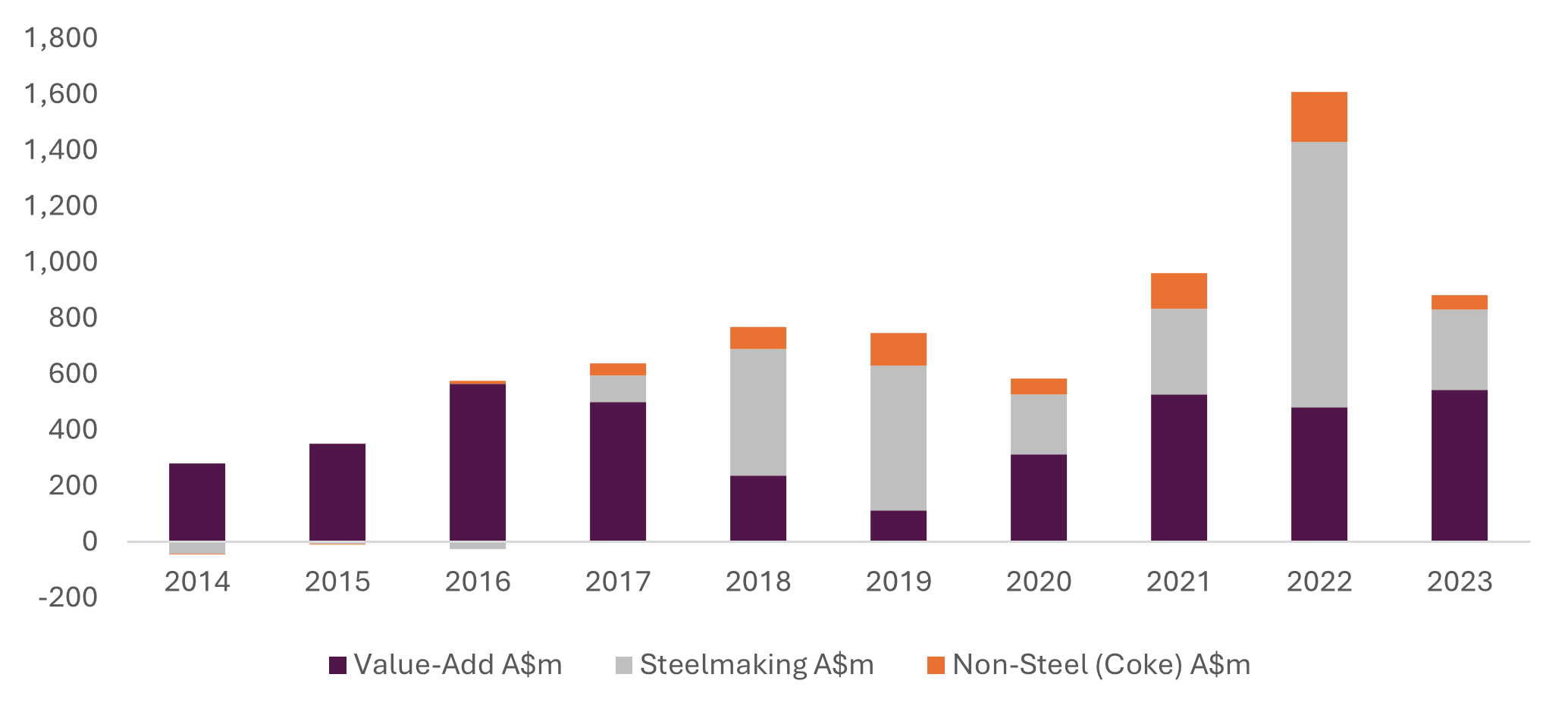

Conceptually BlueScope's Australian steel products segment consists of three earnings buckets – Port Kembla steelworks earnings (excluding coke sales), third-party coke sales and downstream value-added earnings (i.e. BlueScope coating, painting, distribution, branded products). While BlueScope doesn't disclose these buckets of earnings (and internally thinks of the businesses more holistically), we estimate the earnings split, based on publicly available information, to be as follows:

Table 2: Estimated earnings split of BlueScope ASP segment

Source: BlueScope, Airlie Funds Management estimates

Figure 8: Estimated earnings split of BlueScope ASP segment

ASP – EBITDA by Source

Source: BlueScope, Airlie Funds Management estimates

In periods of high steel prices, the earnings of the value-added business (which buys steel at spot) will be hedged by those of the steelworks. We estimate that since 2016 the value-added steel business has made on average ~A$400m of EBITDA. If we put this average on 10x EBITDA – in line with the multiples at which CSR and Boral were acquired – you get a $4b valuation (which is ~50% of BlueScope's current enterprise value). This doesn't include any value for earnings from the steelworks, coke sales or the surplus property in the segment. Also, the figure is a historical average and doesn't account for any through-the-cycle earnings growth as a function of additional downstream capacity, market share gains and price increases.

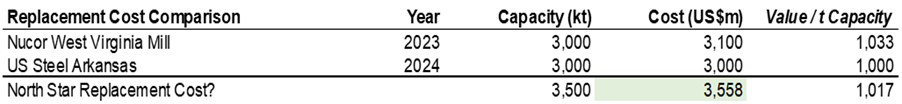

North Star is BlueScope's North American EAF. Post-debottlenecking investment, North Star will have ~3.5mt of production capacity. Peers Nucor and US Steel are currently building new EAFs, which gives us a good idea of the replacement cost of North Star. On a US$ per tonne of capacity basis, North Star is arguably worth ~US$3.6b, or ~A$5b. For context, at US$3.6b, North Star would be trading at 8-9x EBITDA on our mid-cycle spreads. There is an argument that North Star is worth more than its replacement cost given its utilisation is typically higher than the US industry average as a function of its location and the quality of steel produced.

Source: BlueScope, Nucor, US Steel ,Airlie Funds Management estimates

So taking just the Australian downstream business at $4b and North Star at $5b we have the entirety of BlueScope's current market cap, and are effectively getting the Port Kembla steelworks, North American downstream business and Asian businesses at no cost, as well as the cash on balance sheet and any surplus property. Now this is clearly just a back of the envelope type breakdown, but it’s hard to argue BlueScope doesn’t look cheap.

It's the valuation that pulls together the first three parts of our investment thesis and has mades us happy holders in the company. Earnings will go up and down with global steel prices and input costs, but through the cycle we see BlueScope's asset base as attractively positioned for earnings growth and resilient returns. Overlay an excellent balance sheet and strong history of capital allocation, and we believe the medium-term opportunity is compelling.

By Joe Wright, Senior Equity Analyst